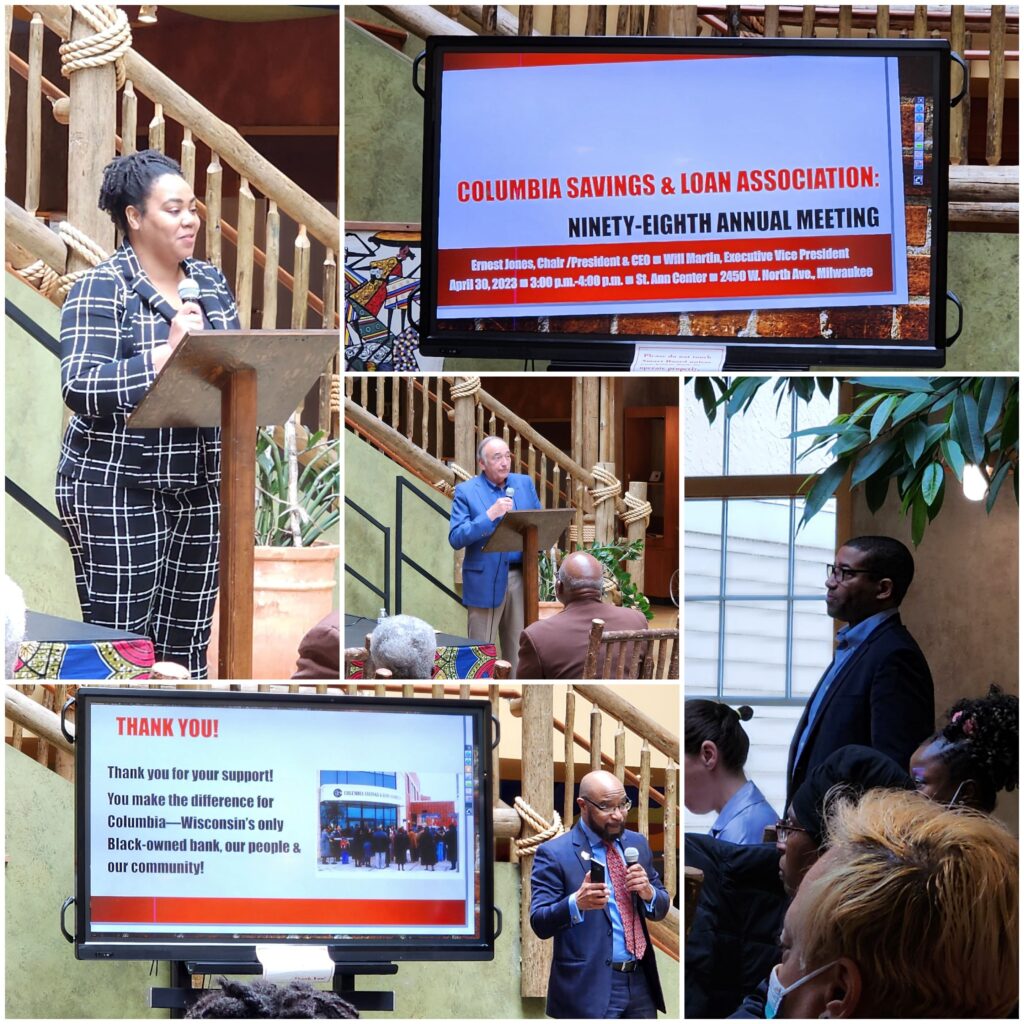

Columbia Savings & Loan Association, Wisconsin’s only Black-owned bank, announced an 18 percent increase in assets and commitment at its Ninety-Eighth Annual Meeting.

Ernest Jones, Board Chair and President & CEO, and newly appointed Executive Vice President Will Martin reported on the new strategies the Board and management have launched since October 2022 to grow the size of the bank. As of December 31, 2022, Columbia Savings & Loan Association had total assets of $24.5 million. Since launching the Association’s growth strategies in February 2023, the new management team has raised an additional $4.5 million in new cash and commitments, according to a press release from the bank.

More than 60 members and guests attended the meeting, making it the savings and loan’s largest Annual Meeting in decades. Attendance was so great that Columbia had to rent space at a much larger facility to accommodate all the participants.

“I have served on Columbia’s Board of Directors since 1983, and have never seen so many people at an Annual Meeting during my 40-year tenure,” Lafayette McKinney said in statement. He remarked that the turnout reflected the community’s deep and ongoing commitment to Wisconsin’s only Black-owned bank and genuine interest in its new initiatives.

Martin announced Columbia Savings & Loan Association is well on its way to raising its goal of at least $10 million in new funding. The new monies will be used to support “100 by the 100th,” Columbia’s campaign to help 100 families become homeowners by the bank’s next Annual Meeting, in April 2024.

“Columbia Savings & Loan Association has been at the forefront of helping families of color become homeowners for nearly a century,” Jones said in a statement. “For every $1 million in new funds raised, Columbia can help 10 more families become homeowners in our community—often for less than they were paying in housing costs while renting.”

Jones and Martin attributed the growth to a series of new partnerships with other banks and the corporate community. Financial institutions and businesses have stepped up to become major depositors. In turn, Columbia is using those dollars to make more mortgages available for the community.

Port Washington State Bank Executive Chairman & CEO Steve Schowalter and Metropolitan Milwaukee Association of Commerce (MMAC) Vice President of Community Affairs Corry Joe Biddle were among Columbia’s capital partners who spoke at the Annual Meeting.

“Our collaboration with Columbia has given us invaluable insight into the unique needs of Milwaukee’s northside, while allowing us to share our time, talents, experience, and funds with the Association,” Schowalter said in a statement.

“I couldn’t be more excited about MMAC’s partnership with Columbia Savings and Loan,” Biddle said in a statement. “Meeting the members and other partners at the Annual Meeting reinforced for me that investment in Columbia has real economic impact for our community and the families working with the bank.”